What is the new customer acquisition cost?

New Customer Acquisition Cost (CAC) measures how much it costs to acquire a new customer through marketing and sales efforts. In e-commerce, CAC reflects the effectiveness of paid ads, social media campaigns, influencer partnerships, and more in driving first-time purchases.

Here’s why it matters:

- Budget allocation: Helps e-commerce businesses understand the cost of acquiring new customers for efficient spending.

- Profitability insight: Knowing CAC allows businesses to balance acquisition costs with lifetime value (LTV).

- Growth measurement: Tracks how marketing efforts drive customer growth over time.

How to calculate the cost of new customer acquisition?

Formula

CAC = Number of New Customers Acquired Total Marketing and Sales Spend

Calculate your CAC right here!

Customer Acquisition Cost (CAC) Calculator

Example

- Total Marketing Spend: $10,000

- New Customers Acquired: 400

CAC = 10,000/ 400 = $25

This means the business spends $25 to acquire each new customer.

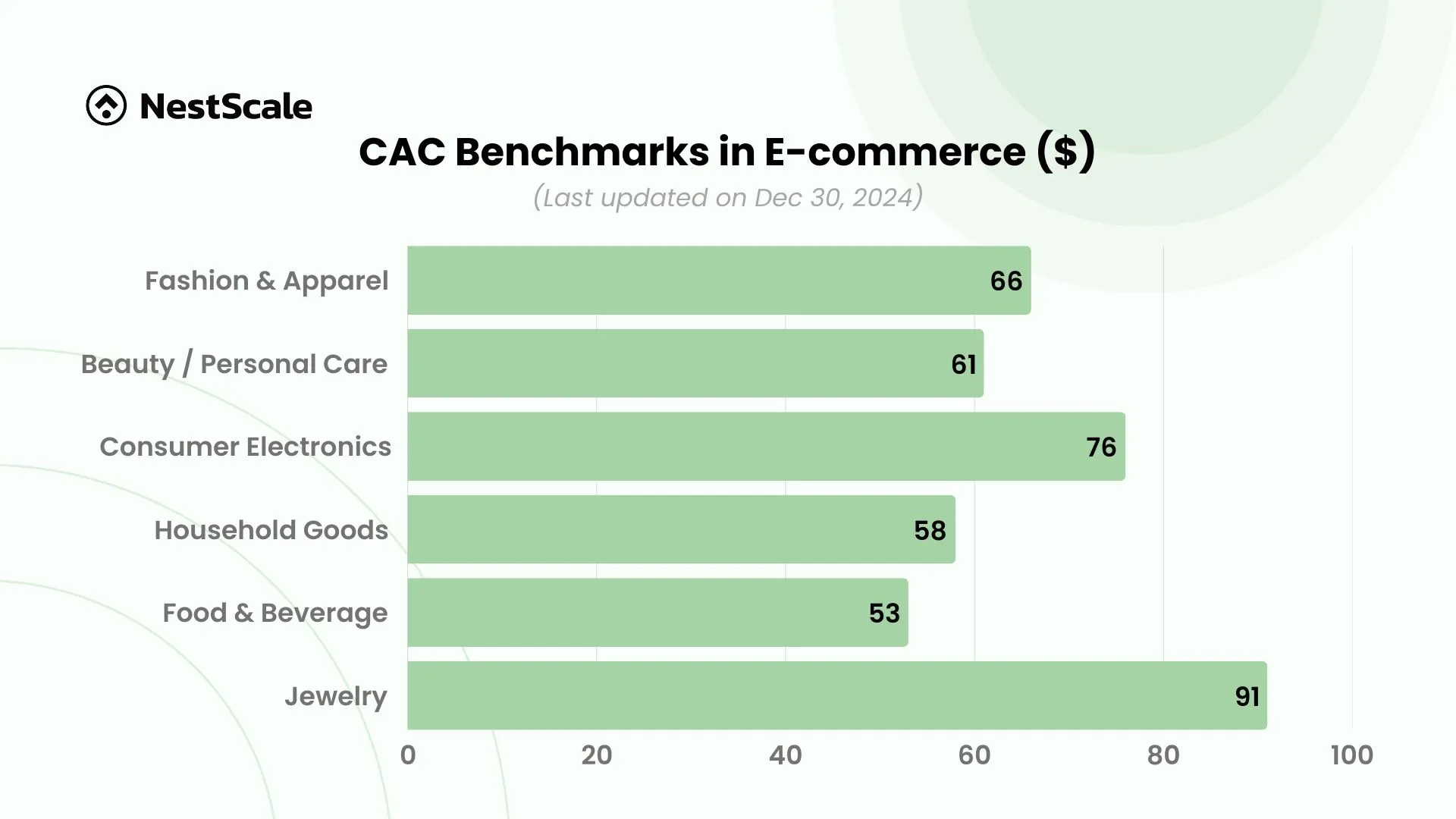

What is the average customer acquisition cost for e-commerce?

The average CAC for e-commerce varies by industry and product type:

💡 If you’re selling something that makes you a lot of money per sale (like luxury goods), you can afford to spend more on marketing to acquire customers. But if you’re selling something with a small profit margin (like groceries), you need to keep your marketing costs low to stay profitable.

What is the relationship between CAC and CLV?

Customer Lifetime Value (CLV) represents the total revenue a customer generates over their relationship with a brand. A healthy CAC-to-CLV ratio ensures profitability and long-term growth.

Key benchmark:

LTV > 3 x CAC

If LTV is three times higher than CAC, your business is scaling profitably.

Example

- CLV: $300

- CAC: $50

Ratio = 300 / 5 = 6

A ratio of 6:1 indicates strong profitability.